Freedom Party of Ontario's 2013

OPPOSITION BUDGET

Submitted on Tuesday, February 12, 2013

to Members of the Ontario Provincial Legislature

Table of Contents

Part I: The Essential Problem

Part II: Non-Solutions

Treating Health, Education, and Welfare as Untouchables

Erroneous Proposals to Eliminate ABCs

"Eliminating Waste" and "Cutting Red Tape"

Health Care: the Key Expenditure

Why Balance the Budget in 2013?

Part III: The Opposition Budget

Overview of the Opposition Budget

Competition & Choice, Not Privatization

Federal Funding Implications of Ending the Government Health Care Monopoly

Budget Implications of Ending the Government's Health Care Monopoly

Federal HST Windfall Transfer

Tax Administration Cost Reduction, Welfare Recipients

Balancing the Budget

Conclusion

PART I: THE ESSENTIAL PROBLEM

According to the 2012 Ontario Economic Outlook and Fiscal Review (hereinafter referred to as the "Outlook"), Ontario is currently running a $13B deficit. Ontario's government is operating on a plan that it submits will balance the budget by 2017-18 without making cuts to education or health care. As recently as March 20, 2012, then-Premier Dalton McGuinty opined that the province's then $214B debt was acceptable because, he explained, the federal government did not remedy its debt crisis until its debt to GDP ratio was 67%, whereas Ontario's ratio then stood at 35%. The Ontario Financing Authority has reported that, as of December 31, 2012, Ontario's debt stood at $273.5B. There is mounting evidence that Ontario's 2013 budget will fail to take serious steps to balance the budget any time soon.

Yet, on February 15, 2012, the report of the Commission on the Reform of Ontario's Public Services (a.k.a. the "Drummond Report") submitted that, far from achieving a balanced budget in 2017-18, the government's plan has Ontario on a path that will give it a $30.2B deficit in 2017-18, together with an accumulated debt of $411.4B. The government has rejected the adoption of the Drummond Report's two key explicitly quantified expenditure cuts: elimination of the $1.5B full-day kindergarten program, and elimination of the $1.0 Ontario Clean Energy Benefit.

Meanwhile, the two opposition parties having seats in Ontario's Legislature are nearly mute when it comes to numerically explicit proposals demonstrating how they would get Ontario's budget deficit to zero. Little wonder, given that both parties campaigned in election 2011 on the Liberal government's promises: a balanced budget by 2017-18 without cuts to health care or education. Were the PC party or the NDP currently to hold a majority in the Legislature, it would not have any more inclination to balance the budget than has the governing Liberals.

Ontario does not merely deserve better. We need better, and we need it now. Ontario both deserves and needs a counter-proposal to the anticipated government budget, which it appears will make no serious effort to avoid saddling Ontario taxpayers with crippling debt, hence higher taxes, hence an undesirable locale for business, jobs, and earning. Ontario needs an adult, responsible, rational proposal for balancing the budget in the immediate term, without further undermining the quality of the one service most important to all Ontarians: health care.

Freedom Party of Ontario's Opposition Budget provides a framework for achieving a balanced budget in 2013, and for thereby avoiding the fiscal calamity about which the Drummond Report has warned the province. Moreover, it provides a solution that will take Ontario off of its current trend of ever-increasing expenditures by remedying fundamental economic and medical problems inherent in the current system of delivering health care.

PART II: NON-SOLUTIONS

Before considering the Opposition Budget set out in Part III, it is important to take a clear look at the fallacies inherent in the alleged solutions typically proposed by opposition parties. The fiscal situation in Ontario is too critical to play make believe with easy-sounding non-solutions.

Treating Health, Education, and Welfare as Untouchables

Tables 3.8 and 3.9 of the Outlook provides the following "Actual" 2011-2012 Revenue, Expense and Deficit figures for the 2011-2012 year (the most recent year for which "Actual" figures have yet been published by the Ministry of Finance):

Total Revenue: $109.773B

Total Expense: $122.742B

Deficit: $ 12.969B

There are four areas of expenditure that are considered by some to be politically Untouchable: health care, education, welfare, and debt service. Table 3.9 of the Outlook provides the following Actual totals for Untouchables in the year 2011-12:

- Health and Long Term Care ($46.476B)

- Training, Colleges and Universities ($7.128B)

- Education ($22.925B)

- Community and Social Services ($9.361B)

- Interest on Debt ($10.082B)

The total expense for the five Untouchable items is listed above $95.972B. Therefore, after removing the cost of Untouchables from the provincial government's $122.742B total Actual expenditures for 2011-12, total Actual expense for all other ministries (i.e., the 22 remaining "Touchable" ministries) combined is only $26.770B.

As noted above, the "Actual" deficit in the same period is represented, in the Outlook, to be: $12.969B. Therefore, if one seeks to balance the Ontario budget in 2013 without making cuts to Untouchables, 48.4% of the total ($26.770B) expenditure on Ontario's 22 Touchable ministries (i.e., the 22 other ministries listed in the Outlook) must be eliminated.

To get a better sense of just how large that reduction would be, if the government were to refuse to reduce expenditures in Untouchable ministries, then, of the 22 Touchable ministries, the government would have to eliminate entirely as many as 16 (i.e., 73% of) Touchable ministries (i.e., the 16 smallest Touchable ministries, having total expenditures of $6.324B) to balance the budget in 2013. Whether by making cuts to the expenditures of all Touchable ministries, or by closing as many as 16 of them, the impact on such things as justice, child services, transportation, aboriginal affairs, energy, the environment, citizenship/immigration etc. would be so large as to render some or all of those ministries either utterly dysfunctional or non-existent.

Clearly, if the budget is to be balanced we cannot rule out changes to health, education, or welfare. Nothing can be treated as an Untouchable.

Erroneous Proposals to Eliminate ABCs

It is sometimes suggested that, without making cuts to health care or education, the budget could be balanced first and foremost by eliminating any Ontario agency, board, or commission (the so-called "ABCs" of government) that cannot justify its existence. For several reasons, that argument cannot withstand serious scrutiny.

First, the ABCs are funded by provincial Ministries. For example, for the year ending March 31, 2012, the operating expenses of ABCs funded by the budget of Ministry of the Attorney General totaled $70,622,839 (source: Public Accounts of Ontario 2011-2012, p. 2-38; hereinafter referred to as the "Accounts"). Contrary to what you will hear from those who pretend that the budget can be balanced by cutting ABCs, most people have indeed heard of these ABCs, which include: the Alcohol and Gaming Commission of Ontario, the Assessment Review Board, the Ontario Municipal Board, the Environmental Review Tribunal, the Ontario Human Rights Commission, the Human Rights Legal Support Centre, and the Law Commission of Ontario. Eliminating such ABCs to eliminate their associated expenditures would have no effect on the provincial budget unless the budgets of the Ministries that funded the closed ABCs were reduced by the same amount.

Second, many of Ontario's ABCs receive their funds from the Untouchable health and education ministries: the very ministries whose budgets the Liberal, NDP, and PC parties vow not to reduce. For example, the Ministry of Health and Long-term Care not only funds 14 Local Health Integration Networks (the "LHINs"), but also funds administrative support to: the Ontario Review Board, the Consent and Capacity Board, the Health Services Appeal and Review Board, the Health Professions Appeal and Review Board, and the Ontario Hepatitis C Assistance Plan Review Committee (Accounts, p. 2-222). Similarly, the Ministry of Education funds the Ontario Education Communications Authority (a.k.a. TVO; Accounts, p. 2-142)). If one were on the one hand promising not to make cuts to health care and education, and promising on the other hand to eliminate ABCs that cannot justify their existence, then even if one were to eliminate all ABCs funded by the Untouchable health and education ministries, there would be no actual decrease in expenditures because there would be no corresponding cut to the budgets of the ministries that funded them (i.e., to the budgets of the health and education ministries).

Third, the vast majority of Ontario's ABCs have budgets so small that they do not even need to be reported in Ontario's Public Accounts. Even if one were to eliminate all ABCs, including those funded by the Untouchable ministries, one could not come close to eliminating Ontario's $13B budget deficit.

"Eliminating Waste" and "Cutting Red Tape"

It is sometimes proposed that the budget can be balanced by "eliminating waste" or "cutting red tape", without making cuts to health care or education. However, if no reductions were made to the budgets of Untouchable ministries, the government would be left trying to find $12.969B in "wasted" government expenditures in the $26.770B spent on Ontario's 22 Touchable Ministries. In other words, it would have to be true that an incredible 48.4% of all of the money spent by all Touchable Ministries is pure waste.

In fact, even if health care were treated as the only Untouchable, and waste were also sought in the education and welfare files, 17% of the resulting $76.266B touchable expenditures would have to be waste. Even that percentage stretches plausibility.

It might well be argued that "waste" includes paying public sector employees wages that are higher than that paid to people who do the same kind of work in the private sector. And, given that wages account for a large percentage of all government expenditures, one most certainly could significantly reduce the deficit by bringing public sector wage rates down to market rates.

However, those who are currently speaking of eliminating waste and cutting red tape do not include above-market wages in their definition of "waste". The public sector "wage freeze" some propose is not a proposal to reduce wages: to the contrary, it is a promise not to reduce them. Nor would market rate equivalency be achieved by allowing all companies to bid on government work (i.e., open tendering), because all companies making a tender would seek compensation greater than that which they can obtain in the private sector due to government's taxation powers and its greater spending capacity. With above-market wages excluded from the definition of "waste", it is highly doubtful that the government would be able to identify as waste 48.4% of the budgets of Touchable ministries.

HEALTH CARE: THE KEY EXPENDITURE

According to the Outlook, the Actual 2011-12 cost of health care in Ontario was $46.476B, which figure represents 37.9% of all provincial expenditures in the same period. Actual health care costs for 2011-12 represented 42.3% of total provincial revenue from all sources, and consumed fully 61.5% of Ontario's $75.598B in tax revenues. Numerous credible reports warn that escalating health care expenditures will increasingly undermine Ontario's fiscal health.

The Drummond Report stated that were no changes made to Ontario's policies, programs, or practices, "...the deficit would more than double to $30.2 billion in 2017–18 and net public debt would reach $411.4 billion, equivalent to just under 51 per cent of the province's GDP" (p. 2). It explained that, to balance the budget, "most of the burden of eliminating the $30.2 billion shortfall in 2017–18 must fall on spending" (p. 2).

A 2011 Fraser Institute report cites 19 other reports opining that the current growth in health care spending simply is not sustainable. The Fraser Institute elsewhere has projected that health care spending will consume 75% of provincial tax revenues by 2019, and 100% of provincial tax revenues by 2030, unless Ontario significantly restructures health care.

A February 2, 2012 report by the Conference Board of Canada submitted that if Ontario's health care expenditures were increased more slowly than they currently increase, such that they would account only for an aging population and the effect of price inflation, health care spending would grow an average of 4.7% per year. The report concluded that, under that scenario, the provincial government would be unable to balance its budget even by 2031. The report also concluded that if Ontario instead were to keep health care spending in line with what it said was an historically-observed annual 5.6% rate of increase, Ontario's budget could be balanced by 2017-18 by increasing the provincial portion of the HST from 8% to 15%: a staggering 54% increase in the HST burden of people living in Ontario.

The Drummond Report also submitted that:

"Adjusted for age, Canada definitely has one of the most expensive systems." (p. 154).

It continued:

"The high cost of our health care system could perhaps be forgiven if the spending produced superior results. It does not.

Canada does not appear in a favourable light on a value-for-money basis relative to other countries." (p. 155)

And concluded:

"The clear danger is that if we do not seize the opportunity to begin creating a more efficient system that delivers more value for the money we spend on health care, one or two decades from now, Ontarians will face options far less attractive than the ones we face today. Unless we act now, Ontarians will be confronted with steadily escalating costs that force them to choose either to forgo many other government services that they treasure, pay higher taxes to cover a relentlessly growing health care bill, or privatize parts of the health care system..." (p. 202)

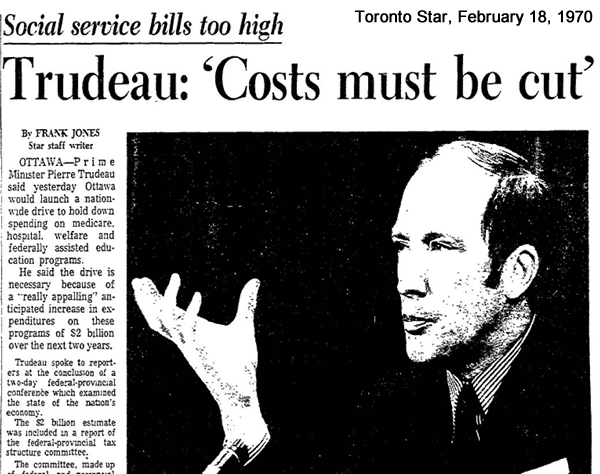

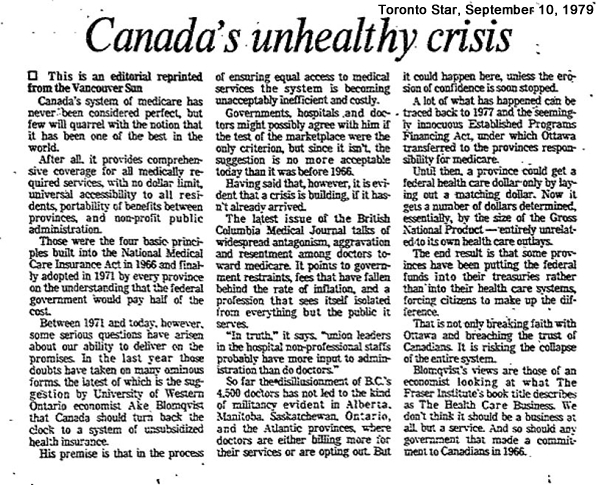

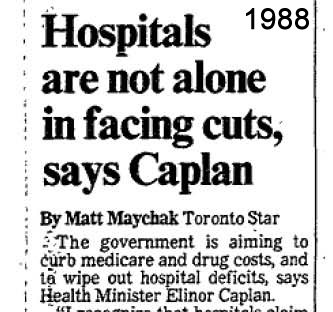

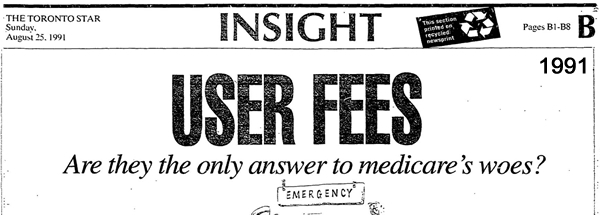

However, despite the recency of some of these reports, it would be a mistake to conclude that ever-increasing health care costs are a recent phenomenon, or that they are due only to an aging population (or to price inflation). In point of fact, Ontario's health care system has been said to be in "crisis", or to be "under-funded", every year since 1969, when Ontario's Progressive Conservative government banned private health payments, and instituted a tax-funded government health insurance monopoly, OHIP.

The essential, perennial economic problem is that the current tax-funded model for health care eliminates any direct economic connection between the health care provider and the patient. There is no personal cost to the patient for choosing to obtain health care services, so each patient's decision to request health services utterly disregards any consideration of the affordability of the services requested. The demand for health care is virtually unlimited.

So long as demand is not limited by considerations of personal affordability, either tax revenues must rise to whatever level of demand is desired by health care recipients, or demands must be met with denials of health care services.

Increasing tax rates results, ultimately, in reduced economic growth. Reduced economic growth reduces potential tax revenue growth. It simply is not feasible to continue raising tax rates at the rate of the increase in health care costs. Continuous increases of annual tax rates amount to an increased disincentive to the production of goods and services in the province and, ultimately, to a reduction in the provincial tax revenues upon which health care currently depends.

The other alternative - denial of health care - is not truly a means of maintaining Ontario's health care monopoly. A good or service that becomes denied (e.g., that is de-listed, or that is delayed until the patient no longer can benefit from the good or service) ceases to be a part of Ontario's health care system: service denial, in its various forms, is a cannibalizing of the government's health care monopoly, not a means of maintaining it.

Denial of health service takes two forms. Where a denial of service results in the good or service being made available in the private sector (e.g., de-listed eye examinations), Ontario essentially is privatizing that part of the system. Where, instead, the province maintains a monopoly on the payment for and provision of a good or service, yet denies the service to those who need it (e.g., by way of delays that render the service no longer to be of any benefit to the patient because the patient has recuperated, has deteriorated beyond the point at which treatment is effective, or has died) the government is rationing, and the cost of that rationing is the health, physical

comfort, mobility, or even the life of those waiting for care.

Privatization is not a method of preserving Ontario's health care monopoly: by definition, privatization is the opposite of maintaining a government monopoly. Moreover, neither privatization nor rationing are intended to be ways to maintain or improve the health care provided by the government health care monopoly: both privatization and rationing are simply intended as means by which the government attempts to prevent the province's health care monopoly from pushing Ontario's budget into bigger deficits.

The take home message is clear. The spending side of Ontario's budget deficit problem is attributable primarily to rising health care expenditures of the Untouchable health ministry, not to the expenditures of Touchable ministries. To balance the budget, health care must be the focus of the effort.

Ontario must decide whether its goal is to provide for the health of the government health care monopoly, or to provide for the health of patients. If the government wishes save patients, it can no longer make saving the current system its priority. Tax revenues cannot be expected to rise sufficiently to afford the soaring costs of saving patients within Ontario's health care monopoly. The monopoly, and its tax-funded, single-payer implications, must be ended if patients are to be well served, and if the budget is to be balanced.

WHY BALANCE THE BUDGET IN 2013?

Ontario's 2012 budget set out a plan alleged to have the province balancing its books by 2017-18. The Drummond Report submitted that the government's plans would not allow it to balance the budget by 2017-18. The aforementioned Conference Board of Canada report suggests that, without a staggeringly high tax increase, Ontario will not even manage to balance its budget by 2031, due to the cost of the government's health care monopoly.

Though such reports differ in their conclusions, the reports make one thing abundantly clear: all talk of balancing the budget five or nineteen years hence is ultimately the stuff of pure speculation about future revenues, together with overly optimistic assumptions about health care and other costs going forward. In

other words: such talk is based upon speculation about the future state of the economy. Moreover, such target dates serve only to get an incumbent government past any election that will precede the target date for balancing the budget.

Given the fact that planned future budget balancings founded on speculation may never be realized, and given the various budgetary problems associated with allowing the debt to climb in a period of limited economic growth, there is no justification for waiting for the right time to balance the budget. The right time is now.

Fortunately, there is a way to balance the Ontario budget now. Moreover, it can be done now in a way that actually improves health care while keeping its cost within an economically feasible range.

What follows is Freedom Party of Ontario's Opposition Budget for the year 2013. We acknowledge from the outset that some of the associated changes required might take months to implement, but we regard the commencement of that implementation to be something done pursuant to a 2013 budget.

PART III: THE OPPOSITION BUDGET

OVERVIEW OF THE OPPOSITION BUDGET

The Opposition Budget makes 10 recommendations in respect of the 2013 Ontario provincial budget, which are discussed in greater detail in the remaining sections of Part III:

1. Take health care off-budget - discontinue tax funding for health care - thereby immediately reducing annual budgetary expenditures by $46.476B, and thereby insulating the Ontario budget from any future increase of health care expenditures.

2. Set up a Crown corporation, funded solely by OHIP insurance premiums, to administer OHIP. Premiums initially to be set for all insured individuals at the approximate $3,441 per annum per capita cost of health care for 2013.

3. Repeal Ontario's production taxes, so that Ontario residents have the money they need to purchase their choice of health care

payment options: OHIP, private health insurance, or cash/credit payment.

4. With the exception of the HST, repeal Ontario's consumption taxes.

5. Impose a 2.4% increase in the HST rate to fully offset the revenue lost from the repeal of Ontario's other consumption taxes.

6. Secure from the federal government the $2.772B federal portion of the HST windfall that will result from repealing the aforementioned production and consumption taxes.

7. Reduce the budget of the Ministry of Finance by $0.9B to reflect the $0.9B savings resulting from the proposed repeal of Ontario's production and consumption taxes (other than the HST). Earmark the $0.9B savings for ensuring payment in full of the OHIP premiums of Ontario's 250,000 welfare recipients.

8. Eliminate all-day kindergarten ($1.5B per annum) and the Ontario Clean Air Benefit ($1.0B), as recommended by the Drummond Report.

9. Impose an overall budgetary spending reduction of 6.4% as compared to 2011-2012 expenditures on non-health items.

10. With respect to reducing budgetary spending by 6.4%, focus upon bringing public sector wages in-line with average private sector wages paid for similar work via a Public-Private Pay Equity Act.

COMPETITION & CHOICE, NOT PRIVATIZATION

Ending the Ontario government's health insurance monopoly does not require privatization of OHIP. It requires the restoration of competition, and a re-establishment of the economic link between the provider of health care services, and the purchasing decisions of the patient. Competition does not imply that the government should cease to offer insurance (i.e., OHIP) for health care services. It means that patients should be able to choose alternatives to OHIP, such as private insurance or cash/credit payments. It means that health care should cease to be funded by tax revenues; that it should be an off-budget expense of Ontario residents. That implies that taxes currently collected to pay the cost of health care must be reduced or eliminated so that Ontario residents have the money they need to purchase the health care or health insurance of their choice. It means that those who choose to continue to be covered by OHIP will pay OHIP directly for that insurance, rather than paying for OHIP through taxes. It means that those who choose to be covered by another insurer will pay that insurer for the insurance, and that those who choose not to purchase insurance will be free to save their money and pay health care providers directly for the services they obtain, when they obtain them.

Nor does ending the government's monopoly necessarily imply discontinuing the practice of providing free health care to those who produce little or no income. Recent estimates of the number of people in Ontario receiving social assistance place that number at between 230,000 and 240,000, all of whom are entitled to free health care from Ontario's health care monopoly by virtue of their Ontario residency. The per capita cost of health care in Ontario (based on population figures set out in the Ministry of Finance's December 2012 Fact Sheet) is approximately $3,441. Assuming the number of people receiving social assistance is currently 250,000, the annual cost of providing free OHIP health insurance to all 250,000 would be approximately $860M (assuming premiums of $3,441.00 per policy).

FEDERAL FUNDING IMPLICATIONS OF ENDING THE GOVERNMENT HEALTH CARE MONOPOLY

Owing to early 20th century fiscal arrangements between the federal and provincial governments respecting the jurisdiction to tax income and respecting the federal government's adoption of central planning, the federal government to this day transfers federal revenues to Ontario's provincial coffer. Currently, the federal funds are categorized as transfers relating to health, education, and welfare (i.e., the Untouchables). According to the Outlook, one such transfer - the Canada Health Transfer - amounted to a $10.705B contribution to the provincial coffer in 2011-12.

The Canada Health Act ("CHA") is a federal statute. Two common fallacies - promoted by proponents of a government health care monopoly - continue to fog the path to a sustainable system of health care. One fallacy is that the CHA limits the legislative discretion of the provinces in respect of health care. That is false because Canada's constitution dictates that the making of health care legislation falls exclusively within the jurisdiction of the provincial Legislature. The other fallacy is that allowing such things as private sector health insurance, direct payments by patients to health care providers, or the elimination of tax-funding for government health insurance would violate the CHA and cause a reduction in Ontario's portion of the Canada Health Transfer. As explained below, that assertion is equally false.

Section 15 of the CHA permits (but does not require) the Governor in Council to order a reduction in the Canada Health Transfer to a province that lacks a "health care insurance plan" meeting the five conditions or "principles" set out in sections 8 through 12 the CHA.

Subsection 8(1)(a): "In order to satisfy the criterion respecting public administration, the health care insurance plan of a province must..."

Section 9: "In order to satisfy the criterion respecting comprehensiveness, the health care insurance plan of a province must..."

Section 10: "In order to satisfy the criterion respecting universality, the health care insurance plan of a province must..."

Section 11(1)(a)/(b)/(c): "In order to satisfy the criterion respecting portability, the health care insurance plan of a province must..."

Section 12(1)(a)/(b)/(c)/(d): "In order to satisfy the criterion respecting accessibility, the health care insurance plan of a province must..."

In each partial quotation above, the phrase "health care insurance plan" has been italicized because to know what sort of health care system satisfies those five conditions requires one to take note that the five

conditions apply only to what section 2 of the CHA defines as a "health care insurance plan":

"health care insurance plan" means, in relation to a province, a plan or plans established by the law of the province to provide for insured health services (emphasis added)

That definition makes it clear that, throughout the CHA, the term "health care insurance plan" does not refer to a plan that is not "established by the law of the province". It does not refer to the provision of health care services, to private health insurance plans, or to private cash payments for health care services.

A proper interpretation of the CHA requires a recognition of the fact that:

1. the CHA neither states nor implies that the "health care insurance plan" of the province" be the only health insurance plan in the province;

2. the CHA neither states nor implies that the province prohibit the purchase and sale of for-profit or non-profit health care insurance that is administered and operated by private persons; and

3. the CHA neither states nor implies that the province must compel individuals to pay for, or be covered by, the province's "health care insurance plan": the CHA does not require that all Ontarians be covered by OHIP. Rather, section 12 ("Accessibility") of the CHA requires only that the health care insurance plan of a province "...provide for payment for insured health services in accordance with a tariff or system of payment authorized by the law of the province." The CHA is crafted to be compatible with a wide variety of payment models. Nothing in the CHA requires the province's "health care insurance plan" to be paid for with provincial revenues (e.g., tax revenues). Even a voluntary payment of premiums by only those who choose to participate in a province's "health care insurance plan" constitutes a "system of payment" that could be "authorized by the law of the province".

In short, the CHA does not require Ontario to have a tax-funded government health insurance monopoly, or to prohibit health care providers from receiving their pay from patients or their respective private sector health insurers. Accordingly, the discretion given to the Governor in Council in section 15(2) of the CHA would not be triggered by allowing private sector payment alternatives to OHIP (e.g., private health insurance or cash payment), or by allowing health care providers to accept payment not only from OHIP but also directly from patients or from their private sector insurers. Ending Ontario's governmental health monopoly would not give the Governor in Council the discretion to reduce Ontario's Canada Health Transfer.

BUDGET IMPLICATIONS OF ENDING THE GOVERNMENT'S HEALTH CARE MONOPOLY

As explained in Part I, the broad budgetary picture is as follows. Based upon the most recent "Actual" budget data set out in the Outlook (i.e., data for 2011-2012):

Total Revenue: $109.773B

Total Expense: $122.742B

Deficit: $ 12.969B

Ontario health care spending is chiefly comprised of Health and Long Term Care ($46.476B). Making OHIP the responsibility of a Crown corporation funded by insurance premiums rather than tax revenues would remove this spending from the budget, leaving a net budgetary expenditure of: $122.742B - $46.476B = $76.266B.

The Harmonized Sales Tax ("HST") is a consumption tax administered not by Ontario's Ministry of Revenue, but by the Canada Revenue Agency ("CRA"). In 2011-12, Actual revenue from the 8% provincial portion of the HST was $20.159B.

According to the Outlook, in 2011-12, the remaining Ontario provincial taxes (which, prior to its merger with the Ministry of Finance, were collected by the Ministry of Revenue at a cost of between 0.9B and 1.0B, as reported in the 2010 and 2011 economic outlooks) raised the following revenues (in Billions), respectively:

Consumption Taxes

| Gasoline Tax |

2.380 |

| Land Transfer Tax |

1.432 |

| Tobacco Tax |

1.150 |

| Fuel Tax |

0.710 |

| Beer & Wine Taxes |

0.561 |

| Electricity Payments-in-Lieu of Taxes |

0.367 |

| "Other Taxes |

0.574

______ |

| Sub-total |

7.174 |

Production Taxes

| Personal Income Tax |

24.548 |

| Corporations Tax |

9.944 |

| Education Property Tax |

5.765 |

| Employer Health Tax |

5.092 |

| Ontario Health Premium |

2.916

______ |

| Sub-total |

48.265 |

Total Revenue from Provincial

Taxes other than HST

|

______

55.439 |

It will be noted that Ontario's health care expenditure of $46.476B is paid for entirely by production taxes totaling $48.265B. This indicates a further disadvantage of our single-payer, tax-funded model of health care funding: it accounts almost entirely for a regime of taxes that discourages production, earning, and saving in the province.

Federal HST Windfall Transfer

This Opposition Budget recommends that Ontario's Consumption Taxes and Production Taxes, listed above, be repealed, leaving HST as the sole source of provincial revenue. The $55.439B revenue no longer collected through the repealed Ontario Consumption and Production taxes will thereby be left in the hands of the taxpayer. Those funds will be used to purchase goods and services, which will be taxed by the HST. Accordingly revenues from the HST will increase. Given that the HST revenue increase will be attributable to the repeal of Ontario's production and consumption taxes (other than HST), there can be no justification in a $55.439B x 5% = $2.772B federal windfall. The 5% federal portion of the HST windfall is rightly payable to the province given that the windfall will be the result solely of tax restructuring at the provincial level. It is therefore recommended that the province demand an annual federal HST Windfall Transfer of $2.772B indexed to the rate of inflation.

Tax Administration Cost Reduction,

Welfare Recipients

The annual cost of administering Ontario's provincial production and consumption taxes (not including the CRA-collected HST), based on the former Ministry of Revenue's expense figures as reported in the 2010 and 2011 economic outlooks, is between $0.9B and $1.0B. Although Ontario's production and consumption taxes are now collected by the Ministry of Finance, it is recommended that that Ministry's budget be reduced by $0.9B to reflect the recommended cessation of tax administration activities for Ontario's production and consumption taxes (other than HST).

Without making other provisions, taking health care off-budget would leave Ontario welfare recipients without the free health care they currently have. Recent estimates place the number of individuals currently receiving welfare at under 250,000 individuals. Ontario's 2011-12 Actual per capita health care expenditures totaled approximately $3,441, such that the total cost of extending free health care to all 250,000 welfare recipients is approximately $0.9B. Accordingly, to provide for the transition to off-budget health care, the $0.9B saved from collapsing the Ministry of Revenue should be set aside for the provision to welfare recipients of free OHIP coverage.

Balancing the Budget

Based on 2011-12 Actual figures set out in the Outlook, the HST raised revenues of approximately $20.159B. The aforementioned $55.439B in tax savings realized by taxpayers would be spent by taxpayers on goods and services, such that total provincial revenues (including the federal HST Windfall Transfer) would be increased by virtue of the application of the 13% HST to those expenditures: $55.439B x 13% = $7.207B.

Taking $46.476B in health expenditures off-budget, repealing $55.439B in Ontario taxes, and increasing provincial HST revenues by $7.207B changes the budget picture as follows:

| Current Total Expenditures |

122.742B |

| minus Health Expenditures |

(46.476B)

_________ |

Net Expenditures

|

76.266B

|

| Current Total Revenues |

109.773B |

| minus Ontario Taxes |

( 55.439B) |

| plus additional HST revenue |

7.207B

_________ |

Net Revenues

|

61.541B

|

Surplus/(Deficit) |

(14.725B) |

The following recommendations would reduce the $14.725B difference noted above to the point of balancing the budget:

1. As suggested by the Drummond Report, eliminate all-day kindergarten ($1.5B) and Ontario Clean Energy Benefit ($1.0B).

2. Increase in the HST rate sufficiently to offset the $7.174B in revenues lost from the repeal of the aforementioned Consumption Taxes. After taking into account additional HST revenue realized from the repeal of Ontario's Consumption and Production Taxes, the 13% HST (excluding the federal HST Windfall Transfer) would provide Ontario with $20.159B + 7.207B - $2.772B = $24.587B. The provincial portion of the HST being 8%, each percentage point would account for $24.587B / 8 = $3.07B. Accordingly, a 2.4% increase in the HST rate would result in an HST revenue increase of 2.4 x $3.07B = $7.368B. A 2.4% rate increase to the Ontario portion of the HST (i.e., 10.4% instead of 8%) is recommended in order to offset fully the $7.174B revenue loss resulting from the proposed repeal of Ontario's other Consumption Taxes.

3. The two recommendations above would

leave a difference of:

| Gross Deficit |

$14.725B |

Kindergarten/

Energy Benefit |

($2.500B) |

| Increased HST |

($7.368B)

_________ |

Net Deficit

|

$4.857B |

It is recommended that the remaining $4.857B deficit be addressed through an additional overall budgetary spending reduction of 6.4% as compared to 2011-2012 spending on non-health budget items:

6.4% x 76.266B = $4.881B

The reduction would leave a small surplus of: $4.881B - $4.857B = $24M. It is recommended that that surplus be earmarked for the costs of transitioning to a competitive, off-budget health care system, including the creation of a crown corporation to administer OHIP.

CONCLUSION

This Opposition Budget provides a means of balancing Ontario's budget in 2013. It strikes the right balance between spending restraint and tax rate increases.

This Opposition Budget also provides a fix to the economic flaw inherent in the single-payer, tax-funded government monopoly system of health care delivery currently in place in Ontario. By re-establishing the economic link between patient and health care provider, and restoring competition, market forces will act to control health care costs while maximizing the per-dollar quality of health care provided.

If implemented, this Opposition Budget will stimulate economic activity in the province by providing North America with a jurisdiction having a low tax burden, and low tax administration burden. In fact, Ontario will be one of only 4 Canada-US jurisdictions imposing no tax on personal and corporate income (the other three are Texas, Wyoming, and Nevada). It will position Ontario as North America's preferred centre for production, earning, saving, investment and innovation. With an aging population, the opening of health care to competition will make Ontario the site of a growing health sector.

As leader of Freedom Party, I hereby heartily recommend a serious consideration of this Opposition Budget by the honourable members of the Ontario Legislature, and by those who dutifully report on their actions...and omissions.

All of which is hereby respectfully submitted this 12th day of February, 2013.

______________________________________

Paul McKeever, B.Sc.(Hons), M.A., LL.B.

Leader, Freedom Party of Ontario

SUPPLEMENTAL HTML-version NOTE:

The following news clippings appear in the .pdf version of this document:

|